Wed 25 September 2019

Spain News | NIE NUMBERS

WHAT IS AN NIE NUMBER:

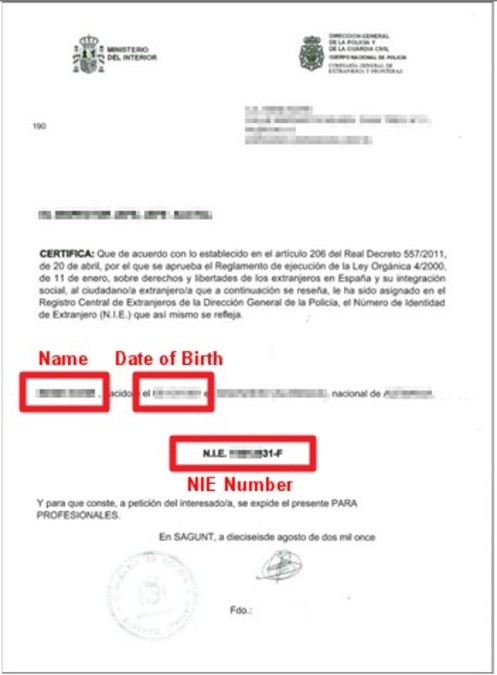

Spain's NIE number is the personal and unique tax identification number that is used to track all financial and legal activities in Spain. The Spanish NIE number acts as a tax and identification number, and is used in all fiscal transactions that involve the Spanish tax office.

WHY DO I NEED AN NIE NUMBER:

A NIE number is needed by all foreigners with legal or tax activity in Spain. Here we explain the simple NIE application process and what you need to get your Spanish NIE number.

Spain’s NIE number is the personal and unique tax identification number that is used to track all financial and legal activities in Spain. The Spanish NIE number acts as a tax and identification number, and is used in all fiscal transactions that involve the Spanish tax office. A NIE number is mandatory for all foreigners with financial, professional or social affairs in Spain, regardless of whether they are a resident or non-resident in Spain. Children also need a NIE number in order to, among other things, get social security.

NIE APPLICATION:

NIE applications can be submitted while living or visiting Spain to the relevant Spanish National Police station dedicated to foreign documentation. You can also apply for a NIE number at the Spanish embassy located in your country.

In Spain, the NIE number can be requested either by you or via an authorised figure, we highly recommend our clients use RODAS CONSULTING S.L lawyers, specialists in property conveyancing for English Speaking clients. The friendly staff will explain the whole procedure and necessary paperwork required.

- NIE application form (EX 15 form)

- Original passport (current and not expired) and one photocopy

- Two small photos

- Government fee (€9.64 in 2019), but this will be increase periodically which you should pay at the bank using a 790 NIE form.